Comments

-

What questions should be included in a survey about ringing?Here is a link to a Google spreadsheet that I did some time ago linking to Guild and Association websites and the e-mail addresses of their contacts. Also there is a second tab listing Branches/Districts and e-mail addresses for their officers:

https://docs.google.com/spreadsheets/d/1hV2NIFaiTA96kp-Gsb3A8TuPu6uN7vptOU-veqgIZJk/edit?usp=sharing

It was done for the Ringing Foundation and ART around ten years ago, so needs updating, if someone wants to take on this and make a copy on their Drive, and updated version would be useful for communicating with and sending out questionnaire links and other things to Branch/District officers.

One thing I have found is that generic e-mail addresses and website URL's don't change much. However, where contact is by webform these are not kept up to date, so any e-mails you send are often not responded to. -

What questions should be included in a survey about ringing?Attached is a copy of the W&P 2019 report in Word format. Phil Barnes or Doug Davis may be able to provide you with a word version of the KCACR one.Attachment

Survey results and feedback 04.04.2019

(116K)

Survey results and feedback 04.04.2019

(116K)

-

What questions should be included in a survey about ringing?I've given you access to a copy of the original survey questionnaire. You should have received a notification to this effect from Google. Please feel free to make a further copy in your own drive and edit accordingly.

-

What questions should be included in a survey about ringing?I would echo the use of Google or Microsoft forms which you can use to collect data by e-mail and export this to a Google sheet or Excel worksheet for further analysis. There are also some useful pre-built graphs on the results page of each application.

Do also talk to people beforehand to find out what the likely responses are, so that you can populate tick box questions. These are far easier to analyse than free form text.

You can also look at previous Guild/Association surveys to get a feel of what questions to ask and likely responses that you will receive. See the attached surveys carried out in Kent in 2017 and W&P in 2019. I still have the Google form from the 2019 survey and can send it to you if you wish, to avoid the need to re-key the questions.Attachments Kent Survey-report-final-v2

(142K)

Kent Survey-report-final-v2

(142K)

Survey results and feedback 04.04.2019

(336K)

Survey results and feedback 04.04.2019

(336K)

-

Association/Guild Direct Membership Organisation??Your modern concept, with which I agree, requires more effort from more people, not only Association and District officers. The first step in any change is to wake up and see that we need to do it, and we are still asleep on this one! — Phillip George

If only those who cling on and try to do everything themselves would learn to let go, it would make a huge difference. There are lots of talented people out there who could step in, they just need encouragement. They may make mistakes at first, and they may try new ideas, but in the longer term as more people are contributing, the workload for individuals will be less, not more.

I'm pretty sure that a lot of people are awake on this one and have been for some time. It's just that the existing culture is very good at reinforcing itself, and is averse to change. -

Association/Guild Direct Membership Organisation??"I am not sure if members have been canvassed about what ringing activities might interest them!

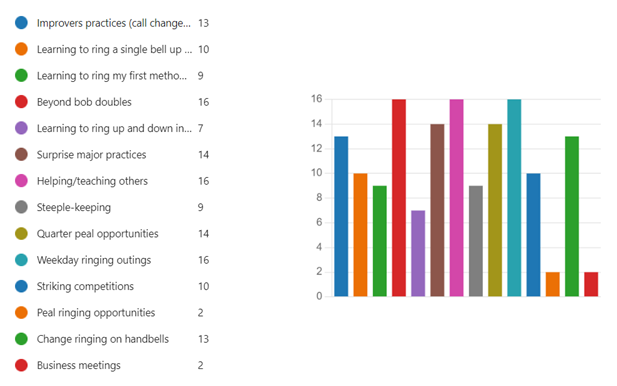

Have a look at this graph from our recent district survey.

-

Association/Guild Direct Membership Organisation??I researched this a couple of years ago and found that in addition to Surrey, the D&N had introduced the LoveAdmin system. Rather than a fall in subs it actually increased the number of people paying subs. Perhaps someone from D&N could comment.

I think the important issue here is engagement with the total membership. My experience is that few people nowadays take up ringing as it is a service to the church. It is no longer seen as a duty to their parish which means that they have limited interest in anything other than their local band. They take up ringing because they perceive it as an interesting hobby. They are quite surprised when they find out about our antiquated ways of doing things compared with other activities that they could take up.

In addition, I know that many tower captains talk about how difficult it is to recruit young people, but just look at the response when we took the Charmborough Ring to the Cambridge University Freshers fair last week. Ringing could have a bright future if only it got organised, brought itself up to date and promoted itself better.

The problem with the traditional system is that too few communications get down to the ringers at grass roots level. Because posts in societies are dominated by long term ringers, there is also a fixation on peals, striking competitions and business meetings, which appeal to a minority. We have just carried out a survey in my local district and these are the bottom three things that the members are interested in.

Communication by direct mail is the #1 thing that they wish to see. Google groups and Facebook groups are only half as popular. However, it's not surprising that WhatsApp groups targeted at those with specific interests (e.g weekday ringing, training events, surprise major practices, handbell ringing, quarter peals etc) are significantly more popular.

If people can pay their subs on-line and receive regular communications about activities that they are interested in taking place nearby and which are of interest to them, ringing will flourish. Activity would be driven in a modern bottom-up way by the membership, rather than the old rigid Victorian top-down way. Certain activities will flourish, and groups may need to split (as in CAMRA) and new previously un-heard of activities might emerge. This might present a challenge to some of the arbitrary boundaries that we have but is something that should be encouraged and welcomed. -

Costs of training to become a bell ringerI think it's unrealistic to expect the keen learners who go on courses to go back and change the culture of their towers - believe me, I tried. I'm not saying it never happens, but as a way of fixing ringing's current problems, I think it's a non-starter. — John de Overa

I disagree. We need to spread good practice. It will be a slow process, but over time the techniques will find their way back into use in towers, even if this is when 'old Fred' retires and someone who knows about other ways of teaching takes up the reins. Just look at how gradually over the last ten years ART's foundation skills techniques are starting to become mainstream.

Since June I've been holding regular foundation skills practices on a Monday afternoon every 2 - 3 weeks. Quite a few learners from other towers in my District are finding out about these improvers practices. There are now about 30 people who have taken part in one or more of them, and it's becoming difficult to cope with their popularity. More attend them than the traditional District practices. I've had some very positive feedback from those that come, as they welcome a fresh approach to their struggles, and I am sure that they are taking the exercises back to their own towers. In fact, following a taster session held at one of these towers on Saturday morning, I've now got three tower captains/teachers from these other towers who want to go on ART M1 and M2 courses to learn more about the techniques.

Once we've got the teaching of bell-handling and foundation skills embedded, we can then concentrate on the teaching of method ringing. -

Costs of training to become a bell ringerOf course the commercial model isn't viable. We rely on the owners of buildings making them available and providing use of some expensive equipment for free, although we might contribute towards the upkeep of the latter. However it's interesting to consider what other inputs such as volunteer time are required to teach someone to ring. We can then consider whether we are making best use of scarce resources.

The model that I costed is based on the typical Guild/Association training day. However in 2 x 2 hour slots each pupil only gets 6 - 8 five minute touches of quality rope time. They may benefit form more practice in their own tower, but in my experience the majority come because they can't do what they want to learn in their own tower, and as these training days are often once a year, they are likely to come back to the same group next year (if they haven't given up in the mean time!).

The Hereford/Bradfield/Essex/NW ringing courses use a similar model, providing around three times as much quality rope time in around six or more sessions concentrated over three/four days. Whilst far less is forgotten between sessions, you probably need to go on two of these courses to to turn a call change ringer who rings with a weak local band into someone who can confidently hunt the treble to QP standard, or progress from this to ringing their first QP inside etc.

The longer courses at the Tulloch Ringing Centre, which make good use of simulators etc is pretty close to the ideal, and people are willing to travel there and pay, but it is not something that could be rolled out everywhere. However the Birmingham School and Bell Ringing and the Mancroft Ringing Discovery Centre are models that could be adapted for use elsewhere, but they do rely on the use of existing facilities and investment to improve them, which are not reflected in their charges.

A much smarter way of making best use of scarce resources would be to use these training days and courses to promote the use of some simple exercises to break down the learning process into easily manageable steps. Those who come from weak bands can then take them back to their own towers to help improve the tuition for the others there. -

Costs of training to become a bell ringerI've given this a little more thought as we've not yet got stuck into Level 3. I do know that the Birmingham School of bell ringing reckons that it takes between one or two terms to progress from one Level to the next. Let's say 15 weeks of two hour sessions with five experienced ringers, and one teacher/leader/stander behind. They could give each of a group of five 'learners' at least three 5 minute touches of quality rope time in each weekly session. In time two learners might be able to ring in the same touch, increasing the amount of rope time, but there would still be a need for the same number of helpers, to stand behind and provide feedback.

Based on my previous figures that's about 180 hours of teacher/helper time for 5 pupils = £720 per pupil per Level. Add on incidental expenses that's probably in excess of £800 per pupil per level.

That's around £3,200 to get to Level 5. -

Costs of training to become a bell ringerWe seem to have drifted a little off topic. To get back on topic, I estimate that it costs over £400 to teach someone to Level 1 of learning the Ropes and £200 for each level thereafter. Therefore to get to Level 5, which is a fairly ‘basic’ standard for a method ringer therefore costs about £1,200 per ringer

A year ago we held a recruitment event at the Cheriton parish fete with the Charmborough Ring. This cost £150 to hire. Plus a little more for transport. We also printed some handouts. We held a taster evening a couple of weeks later and as a result a group of six started to learn. Over the following weeks more joined and we ended up teaching 13 people to handle. We started with a month of intensive handling lessons, with each pupil receiving a series of one hour lessons 1:1 with an instructor. These were scheduled using Doodle Polls and took place several afternoons and evenings in these first few weeks. In total each pupil received on average 12 handling lessons to get to Level 1, most receiving two a week for the first four weeks, although the handling lessons continued for some time afterwards in parallel with learning to ring rounds, and also as more friends joined the group. However, we also lost three of the group over this period, so we ended up with ten new ringers.

To deliver this instruction we had a team of six handling instructors who volunteered to give up their time, some of whom were travelling up to 15 miles to each session, although the average distance was about 7.5 miles. The National Lottery credits volunteer time at £20 per hour and the marginal inland revenue mileage rate is 25p/mile. We also bought each new recruit a Learning the Ropes Personal Progress Logbook at £2.50 each. There were also a couple of cracked stays. Therefore the volunteer time came to £3,120, plus travelling expenses of £585. Including incidentals. The total cost to reach Level 1 of learning the Ropes was about £4,000 or £400 per learner who reached Level 1.

The Winchester District did buy some simulator sensors at a cost of £420 and another ringer loaned a second-hand laptop. There is also the cost of training the teachers. Four of the instructors had previously attended an ART Module 1 teacher training course, although there were two very competent teachers who had not, and everyone worked together well. If you include a portion of these costs, the actual cost is higher than £400 per ringer.

Some of the band rang some good rounds for the Carol service and we then had six weeks off for Omicron. To date we have held about 40 weekly practices and the band is now ringing for some services (because it is part of a large benefice, service times vary from week to week and sometimes there are no Sunday services to ring for) and weddings to rounds and call changes standard (Level 2 of Learning the Ropes) almost entirely on their own. We have been fortunate to be joined by two lapsed ringers living in the village, and four helpers have been coming each week, although the need for this involvement is gradually tailing off. We still have some handling practice for the stragglers before the main practice, and use the simulator as well, but our helpers are not the same group as the handling instructors, so the average travelling distance is about 5 miles. We’ve also given each new ringer the publication A Ringers Guide to Learning the Ropes at £7.50 each, plus another couple of cracked stays (the trebles are very light and flighty, with a high ceiling, and that is something we need to fix by purchasing some rope guides). However, the cost of reaching Level 2 for the ten ringers is going to work out at around £200 each.

We’ve just started on Level 3 for the most advanced members of the group, so rather than tailing off, we’re going to need to retain our helpers for the next and subsequent stages, at a similar level of input for each level. The problem is that with such a large group of rounds and call-change ringers, we can’t teach all of them to plain hunt at the same time, otherwise they will get so little rope time that they forget everything between lessons. Therefore we’re going to need to establish a second practice night, possibly at another silent tower nearby (but that means more travelling) or send some of them away on training days (the Guild has an annual one) and longer courses, but that has a cost too.

Fortunately the learners are far more willing to pay for this tuition than the typical ringer who has been ringing far longer. Although we have not charged, my wine cellar and that of my fellow teachers has been kept generously stocked!!! -

Costs of training to become a bell ringerI was a helper on the new NW Ringing course a couple of weeks ago. What was interesting was that each student was willing to pay £275 for two and half days intensive tuition in their chosen subject. What was disappointing was that each student in my group (and I suspect many of the others) came because they met a barrier to their progress in their own tower, and even after the course, they would have very limited opportunities to ring their chosen method afterwards.

After the course the organisers set up a WhatsApp group for us all to keep in touch. In my feedback I suggested that as there are other similar courses (Hereford, Essex, Bradfield etc) what would be useful would be to link up with them and set up regional WhatsApp groups for each of the subjects, so that students could get together with other like minded people and practice what they were learning on the course. Even as I helper I wouldn't mind joining in for a follow up day later in the year in my part of the country, perhaps with a few quarter peal attempts thrown in. I also suspect others who had not been on the course would be interested in joining in too.

ART has just held its second successful Learning the Ropes day for people at the lower end, but wouldn't this be a good way of harnessing new ways of working to help remove the barriers for people further up the ladder? -

Costs of training to become a bell ringerIn the W&P we have a 'Probationary' category of membership for new ringers. In 2019 we carried out a survey of the membership, which included looking at the progression of the probationary members. Of those who were probationary members in 2015, 49% ceased membership in 2016 and a further 12% in 2017. Only 34% became Full members. The survey also showed that a third (33%) of the Guild's members are either learning to handle, ring rounds and call changes, or plain hunt. Clearly there is not only a tremendous wastage, but also a need for far more investment in training at the foundation skills level to improve retention rates. However, nationally there are several millions of pounds sitting in restoration funds for years on end, at very low interest rates, when inflation this year is forecast to to reach 13%. We seem to have too many bells and not enough ringers. If only we could re-assess the priorities and change the culture!

Guild Education Survey Results and Feedback | WPBELLS -

Guild and society eventsWe achieved this by:

- At Cheriton we had the active support and encouragement of the vicar. We have also been invited to meet the other clergy in the Deanery at a breakfast meeting to discuss how we could help other villages in a similar way and this be reflected in their action plans. Districts and Branches are often very inward looking and have limited contact with the church structures in their area.

- We used the Charmborough Ring at the Parish Fete. Five people left their contact details. We contacted them afterwards and fixed up a 'taster' evening. (too often ringers wait for prospective learners to get back in touch, or just turn up at a practice, but they rarely do. It's about showing an interest in the learner, personal contact and making them feel wanted).

- We followed the taster evening up with three weeks of intensive bell-handling sessions. We had the support of two very experienced peal ringers from other towers in the South of the District (one has rung over 3,000 peals) but neither are ART members, and we are not pushing them to be, but they are very good at teaching bell-handling. In my experience many excellent ringers are only too willing to help, provided that the teaching is done in a structured way.

- We were able to give each pupil two or more one-hour handling lessons with an instructor in the first few weeks. They all had 6 - 8 hours 'rope time'.

- During the first few weeks several more people came forward to learn. They were either friends of the others, or found out through our posts on the village Facebook group

- Around half the pupils were early retired, semi-retired or working from home, so we were able to offer afternoon as well as evening handling sessions. We used Doodle Polls and Google forms to check availability and fix these up.

- We also used the colourful A5 CCCBR flyer with pictures of young people on it. This caught the attention of two teenagers in the village (they soon caught the adults up!).

- We have lost three of the learners, but have taken the trouble to find out why. One was a medical issue, another changed jobs and could no longer come. A third was just too busy and couldn't make many of the practices, and they didn't want to waste our time.

- We have concentrated on good bell-handling and developing listening skills first. Also the concept of knowing which place you are ringing in. We are letting people learn at their own pace and getting the basics right, instead of pushing them too early into method ringing. It takes far longer to un-learn something and then get it right.

- We are in the fortunate that at New Alresford just up the road we have a band that can ring Cambridge Minor, Stedman Triples etc. We need to be careful not to dilute the practices there with a large influx of learners, so we are holding sessions focussed at different levels at different times (Beginners, Improvers, Intermediate, Advanced). Our experienced ringers are helping out with the learners, and the learners are comfortable with visiting neighbouring towers for sessions. We are also developing good social links between both groups of ringers. This is all something which would work less well on a larger scale, such as the District.

- At Cheriton we had the active support and encouragement of the vicar. We have also been invited to meet the other clergy in the Deanery at a breakfast meeting to discuss how we could help other villages in a similar way and this be reflected in their action plans. Districts and Branches are often very inward looking and have limited contact with the church structures in their area.

-

Guild and society eventsThat's not what I was advocating. The local District is quite large (34 towers with 4 or more bells) and covers a large area. It can take over 45 minutes to travel from one end to the other by car. There are several large towns and a city with active bands capable of ringing surprise, and rings of 8, 10, 12 and 14. They might be down a few ringers, but can still ring surprise.

However the northern half of the District is more rural in character and consists mainly of 5's and 6's. It's no good holding 'all welcome' practices as the standards of competence is world's apart. In my corner of the District we are concentrating on the twelve towers in the Deanery, and that is a perfectly viable building block (so long as we are not trying to hold surprise practices, striking competitions, Saturday afternoon meetings, annual training days etc.).

There is a lot of enthusiasm amongst the new ringers and I fear that this would be dampened down if what were trying to do needed to be at District level. The new ringers might only be ringing call-changes and plain hunt now, but I am sure that quite a few will be ringing surprise in a couple of years, and several currently silent or near silent towers will have their own local bands -

Guild and society eventsSome Districts are active, but these were the more active ones before Covid. Others, particularly the more rural ones are struggling. At tower level a number of the rural towers round here have lost key personnel, and those left are content to ring three (in a six bell tower) on Sundays. They have no one to teach new ringers, and these towers now increasingly rely on social media to source ready made ringers for weddings and special services. As parishes are amalgamated into larger benefices and clergy numbers fall, Sunday services are becoming less frequent. It is not unusual in some cases round here to just have one Sunday service a month to ring for. It therefore seems that in the long term local bands ringing at these more rural towers will die out.

At Guild and District level numbers have fallen, and it has proved difficult to find bands to enter striking competitions. It seems that the more experienced ringers are being more choosy on what they do with their time. As an ART Tutor I have also delivered a number of ART Module 1 courses (how to teach bell handling) since Covid. It is noticeable that most of those attending are keen to learn to teach, or are inexperienced teachers who are keen to improve their skills, but this is not matched by the number of experienced teachers who are willing to support and mentor these delegates in the period after the day course. This is essential to help the delegates gain experience and complete their logbooks. If societies don't build on the enthusiasm and train new teachers and tower captains, it's not going to help with the recovery.

I fear that post Covid, ringing will increasingly become concentrated on fewer towers in the larger towns and villages, and the trend for the more ringing to take place outside the traditional structures and Saturday afternoon meetings will continue. The traditional culture is still quite strong and I suspect that its supporters will continue to struggle on and resist meaningful change and improvements. They will be missing out.

Round here we have re-activated a silent tower in a large village over the last nine months. They now have a band of twelve ringers aged 12 - 65, the more advanced of whom are just starting to plain hunt. They are very keen and we have held a number of social events. They have also gone out to ring at some of the other neighbouring towers and we are talking to the local school about using the tower's large set of handbells for tune-ringing.

Whilst a couple of District members helped with intensive teaching of bell-handling in the first few months and we persuaded the District to buy a portable simulator, there has been limited involvement from the District. Practices focussed on methods up to Cambridge Minor and the Standard eight, striking competitions against 'expert bands' and quarterly meetings over half an hour's drive away are of little interest to this band. We have just started holding regular 'Improvers' practices (call changes, kaleidoscope and plain hunt) focussed on this group and others in our local Deanery, and they have proved very popular. By being regular, local and sociable, they will make faster progress than the usual annual training day.

It's adapting to retain the interest of keen new ringers like this that the exercise desperately needs, rather than things returning to the old 'normal'. -

Survey of Ringing 1988I have also uploaded a copy of the 1972 survey here: www.bellringing.co.uk/1972 Survey.pdf

The two reports side by side make very interesting reading. One thing that stands out to me is table 1 where it was estimated that in 1972 10% of all towers were unringable or unsafe. This included 3.9% of eight bell towers; 8.0% of six bell towers and 23.3% of five bell towers. Having just checked on Dove, today's figures are 2.1% of eight bell towers; 2.2% of six bell towers and 22.0% of five bell towers.

When you take into account all the augmentations that have take place since 1972, our stock of ringable towers are in far better condition than they were in 1972. This is mainly due to the support from BRF's, the Millennium commission and the vast amounts of volunteer labour ploughed in. However with an ageing workforce are we going to be able to continue doing this? Also, the vast bulk of unringable towers are 3's, 4's and 5's. Is it sensible to focus the lions share of our resources on these towers, when the problems going forward are going to be parish finances and the number of active ringers per ringable bell? -

Survey of Ringing 1988There is a pdf copy of the 1988 report available online at www.bellringing.co.uk/1988 survey.pdf

-

Insurance when ringingBoth of the scenarios that you paint are somewhat extreme, but are the sort of thing that lead societies take out some form of insurance. However, as we have seen above although members in all four Guilds and Associations above are “insured” in practice whether they are covered, or not, will depend on what the incident is and which policy is in place. And, even if it is covered, the amount that can be claimed will vary significantly. Also, it may already be covered by another policy (e.g. the PCC's) and it is fraudulent to claim against more than one policy for the same incident.

There are many different insurance products available in the marketplace, but many ringers do not appreciate the differences. There is some excellent advice on the SMWG website, but it is not easy to find. https://cccbr.org.uk/wp-content/uploads/2021/01/Insurance-v3.pdf . However, as I explained in my earlier posting, you really need to start with an understanding of property law and the potential hazards, and then undertake a risk assessment.

You need to consider who has a ‘duty of care’ and who has been negligent – Donahue V Stevenson (the snail in the Ginger Beer case). In your example of the learner, would it be reasonable to expect you as a visitor to have such a wide duty of care? wasn’t the tower captain who asked you to supervise a learner negligent?; or was it the person who taught the learner to ring in the first place?; or the PCC in not having a competent tower captain or teacher? Whilst the learner could try and sue you, they would stand more success suing the PCC, who have a duty of care towards their ringers and should be insured to cover this risk. The PCC should also protect you as a visitor, who has permission to be there.

Similarly, if the gudgeon breaks rather than the stay, this tends to indicate a problem with the gudgeon itself. Has it been machined correctly (bell-hangers duty of care) or has the steeple-keeper fitted an over-sized replacement stay? What system is in place to ensure that the steeple-keeper has been trained properly?

As the SMWG advice explains, the situations that you suggest are extremely rare and who is responsible can be extremely complicated. In both cases the PCC (or building owner in the case of a secular building) have duties of care. Normally they will have Employers Liability Insurance to cover their own ringers, and Public Liability Insurance to cover damage by visitors, who have permission to be there. Sometimes, depending on what insurance is in place, your Guild or Association Insurance may cover these incidents as well. Therefore, if you are not personally insured, why would someone bother to sue you, unless you have been reckless, ignored those in charge, and rung without permission. -

Insurance when ringingI think the vast majority of ringers totally misunderstand insurance for ringing and ringers, and many Guilds and Associations spend significant sums of money unnecessarily. Marcus Booth of Ecclesiastical gave an excellent presentation at the ART Conference a few years ago, and a recording is available on ART’s YouTube channel. The presentation was repeated at the CCCBR Roadshow at Goldsmiths.

I am not an insurer, but my experience comes from the other side of the fence. Rather than start by arranging a policy I think it is important for ringers to start by considering the risks and undertaking a risk assessment.

Typical situations could be:

1. Jane a member of the Sunday band at Little Snoring slips down the worn tower steps after Sunday morning ringing. There is no handrail or rope to hold on to, so she falls a long way and breaks several bones. The worn steps have previously been reported to the PCC, but no action has been taken.

2. John the steeplekeeper at Little Snoring needs to check the ropes in his tower for wear. He goes up alone and without a mobile phone and slips off the frame and seriously injures himself. It is many hours before he is found and as a consequence of the delay and his injuries he has to take significant time off work.

3. There is a tall vertical wooden ladder up the bells at Little Snoring, without any hoops or a fall arrest system. The top of the ladder is over 16 feet high above a stone floor and a ringer falls off while attempting to lift the heavy trap door at the top, and is seriously injured. There is no risk assessment in place for use of the ladder, or any routine inspection of it.

4. Peter, a member of the local band at Little Snoring, is electrocuted and dies when switching off a faulty fan heater after practice. No PAT testing regime is in place.

5. John the steeplekeeper is concerned that pigeons have got in to the tower. After replacing the wire netting he removes the pigeon droppings and disposes them. A few days later he becomes seriously ill. No guidance or PPE has been provided by the PCC.

6. James, another member of the local band rings up the tenor on practice night. Unbeknown to the ringers the Vicar (or churchwarden) has let telecomms engineers up the tower. They climbed up the ladder past the tenor and dislodged the slider as they hoisted up their equipment. As they were not ringers they did not know to replace it. No one checked after their visit. James is relatively tall and it is a heavy bell and he had not let the last coil out, when the bell was up. As a consequence when he tried to set the bell, James was lifted several feet into the air and fell awkwardly, breaking several bones, as well as receiving rope burns.

None of these are Guild or Association events. The point I am making is that the PCC have duties under the Health & Safety at Work Act which include the provision of:

a. a safe system of work;

b. a safe place of work.

In addition, the PCC have duties under other legislation and common law.

Therefore, they usually have Employers Liability Insurance, typically with £5 or £10 million cover. As Marcus explained in his presentation, although ‘volunteers’ members of the local band will be treated as ‘employees’ and covered by the PCC’s insurance. In addition, the PCC will also have Public Liability Insurance, which will cover visiting ringers, and other people who could be expected to visit the church (e.g. guests at a wedding).

Therefore Guilds and Association with their own cover might be able to claim against this, but there is usually a clause saying that they will only be covered if there is no other insurance in place. If any of these incidents happened the insurers would then make a claim against the PCC.

Therefore in effect Guild and Association Insurance only covers incidents at Guild and Association events, and for which the Guild and Association is responsible – e.g. despite being warned not to do so, someone lets off the clock-hammers whilst the bells are still swinging and this smashes some wheels and cracks a bell.

Some Guilds and Associations also have personal accident insurance, but this is very expensive and the benefits are very low. £20,000 for a death would not cover the mortgage payments for a young person who is the main breadwinner for a family. As people’s personal financial circumstance vary significantly it is better that they have their own personal accident cover (and many do already).

The Sufffolk Guild paid £390.36 for Members Accident Insurance (up to £5k) and £347.03 for Public Liability Insurance and £103.60 for Property Damage insurance in 2021 InsuranceSummary20201006.pdf (<a href="http://suffolkbells.org.uk" target="_blank" rel="nofollow">suffolkbells.org.uk</a>)

The MCA&LDG Paid £1,045 for Personal Accident Insurance (up to (£20k) in 2021. It does not hold Public Liability Insurance Insurance (bellringing.london)

The Surrey Association paid £533.99 for £1m of Public Liability Insurance in 2021 but holds no Personal Accident Insurance Insurance - The Surrey Association of church bell ringers (surreybellringers.org.uk)

The Gloucester & Bristol DA paid £489 in 2021 so that the Association - and its paid up members as individuals - are insured for £2,000,000 against third party claims for being negligent whilst acting as G&B members. Members are NOT insured against personal injury at all… …they would need to check this with their own PCC. Association Information (bellsgandb.org.uk)

This information is all available with a simple Google search. It demonstrates that there are vast differences between what societies pay and what is covered.

Completing this exercise and comparing all societies would be a very useful exercise and help societies improve value for money for their members.

Roger Booth

Start FollowingSend a Message

- Contact Us

- RingingForums Policy

- Terms of Service

- Useful Hints and Tips

- Sign In

- © 2026 Ringing Forums